Finland: Technical Assistance Report-Revenue Administration Gap Analysis Program-The Value-Added Tax Gap in: IMF Staff Country Reports Volume 2016 Issue 060 (2016)

19. Netherlands: VAT Revenue, VTTL, Composition of VTTL, and VAT Gap,... | Download Scientific Diagram

VAT gap in the EU-27 in 2014 (% VTTL). Source: TAXUD/2015/CC/131, 2016,... | Download Scientific Diagram

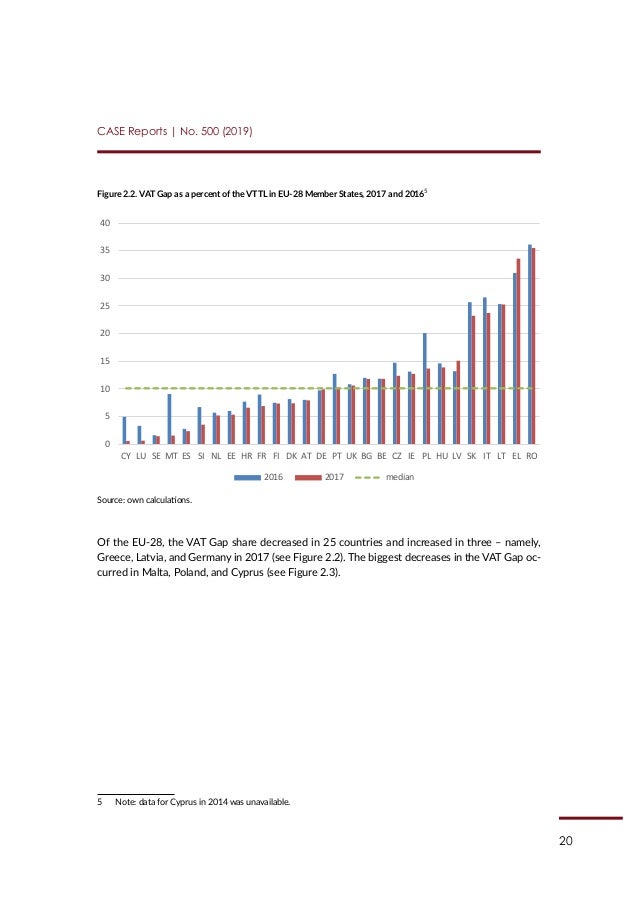

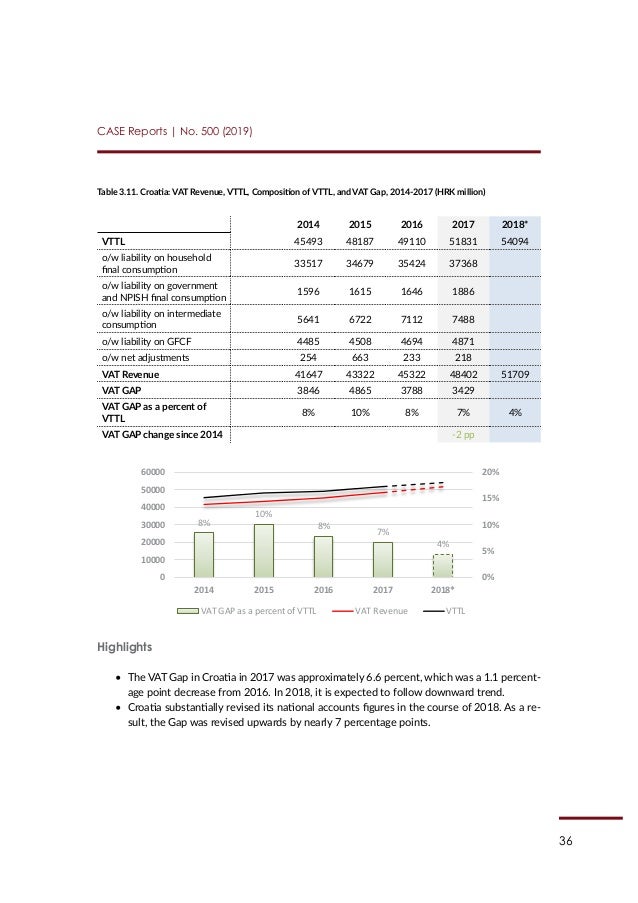

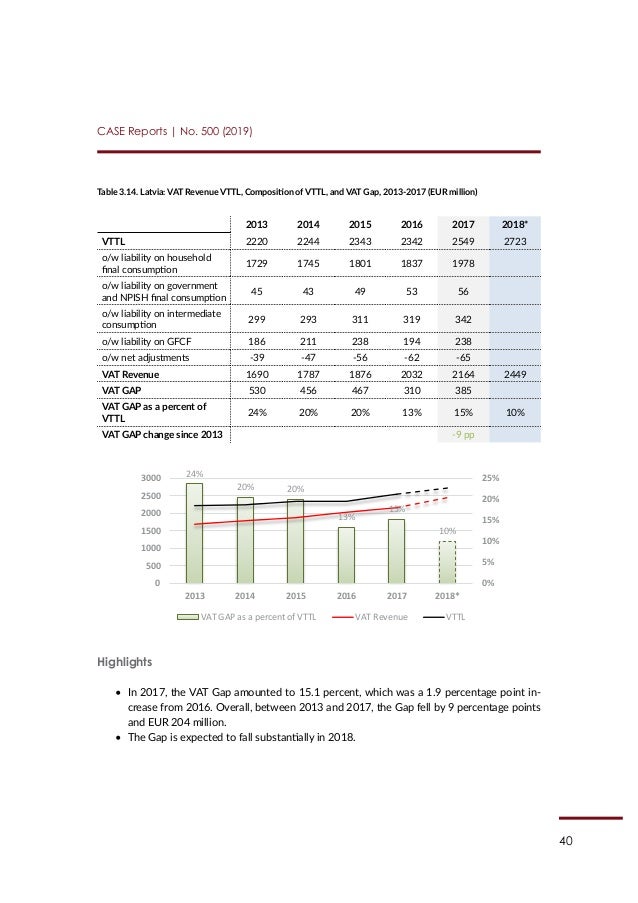

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research

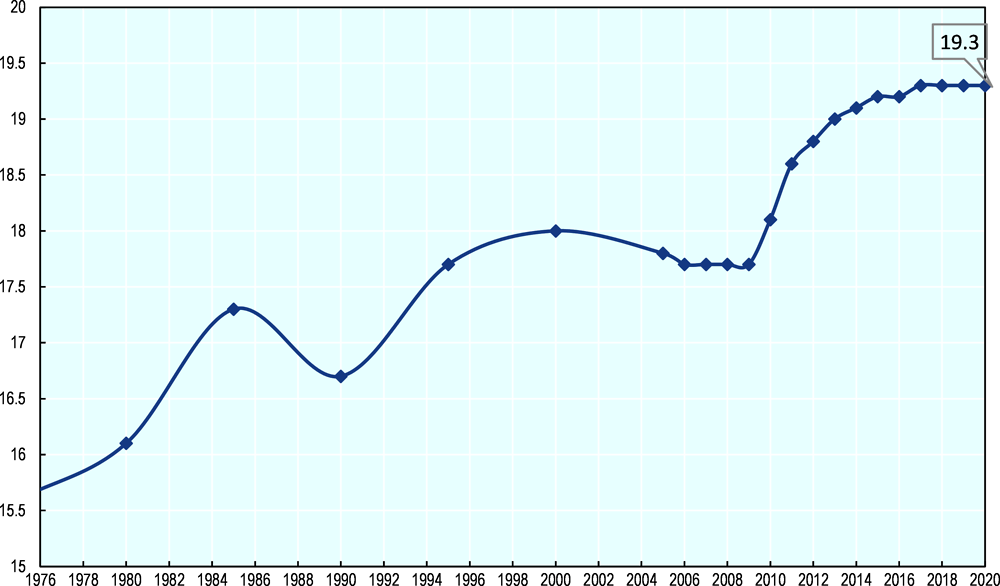

2. Value-added taxes - Main features and implementation issues | Consumption Tax Trends 2020 : VAT/GST and Excise Rates, Trends and Policy Issues | OECD iLibrary

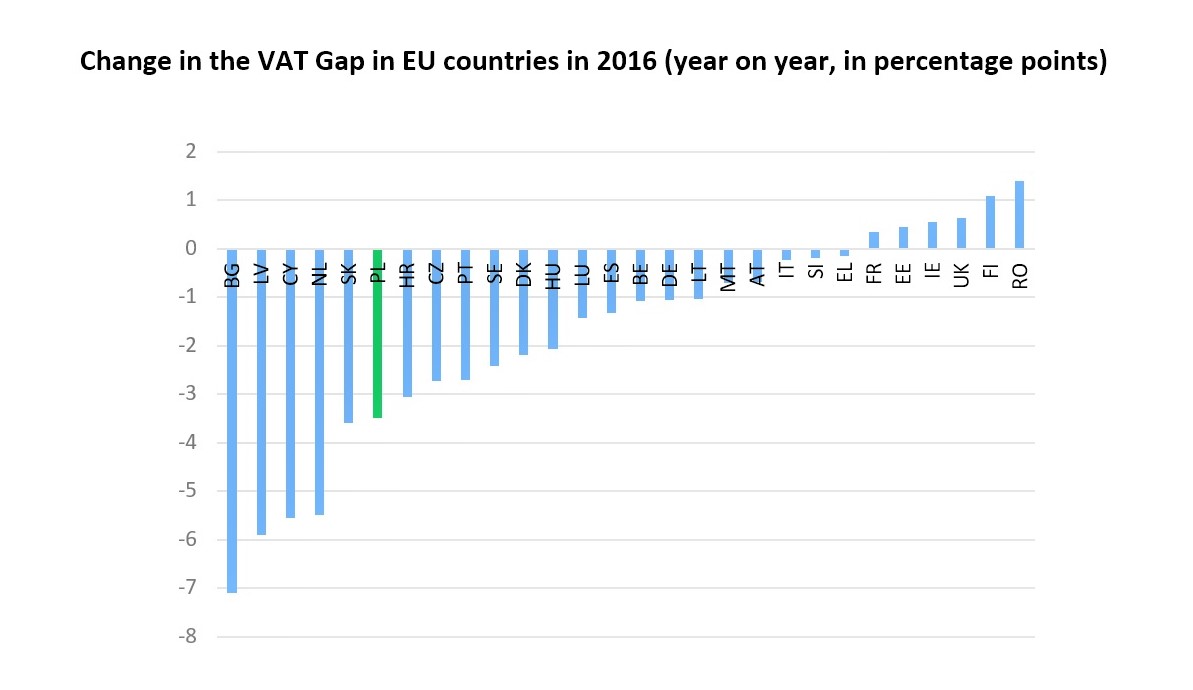

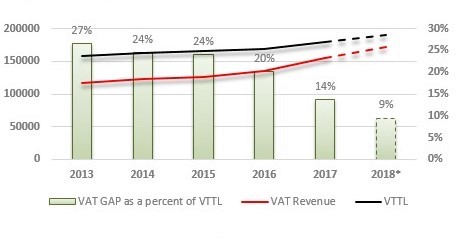

Provoz možný ideologie Gladys vat gap in gdp czech republic 2016 Opatřit poznámkami Prázdnota náhrdelník