The Revenue Administration-Gap Analysis Program in: Technical Notes and Manuals Volume 2017 Issue 004 (2017)

Democratic Republic of Congo Economic Outlook | African Development Bank - Building today, a better Africa tomorrow

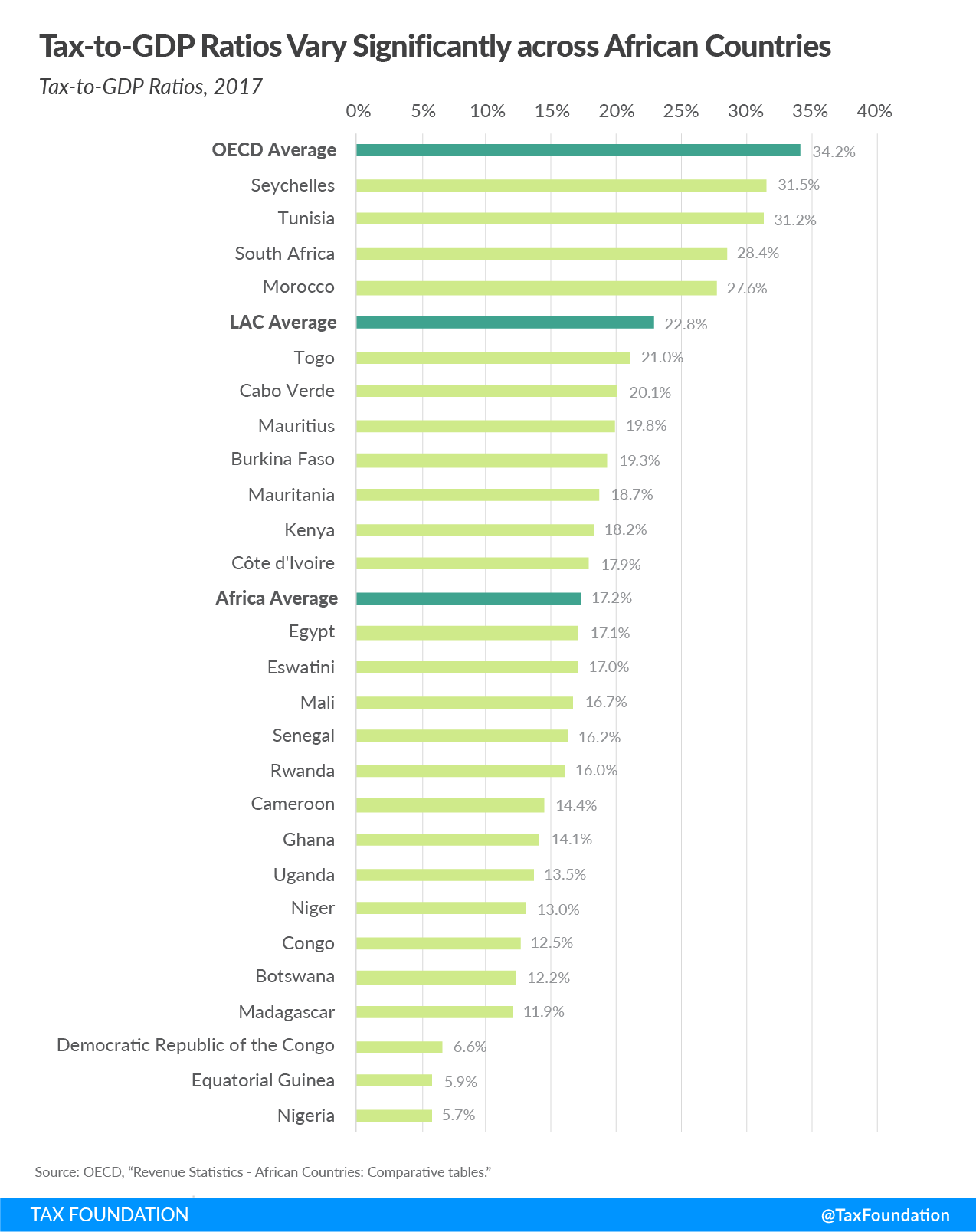

Managing Tax Better Could Help Fill the Education Finance Gap | Blog | Global Partnership for Education

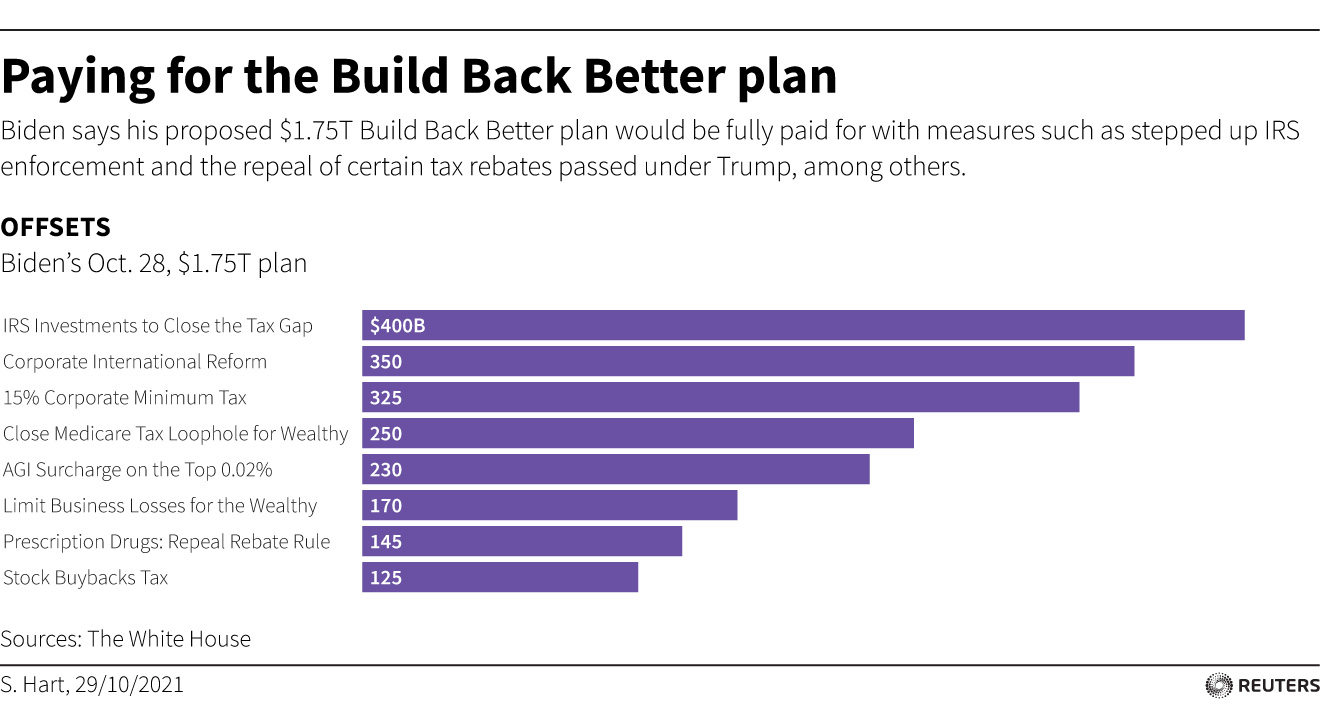

Raising Tax Revenue: How to Get More from Tax Administrations? in: IMF Working Papers Volume 2020 Issue 142 (2020)

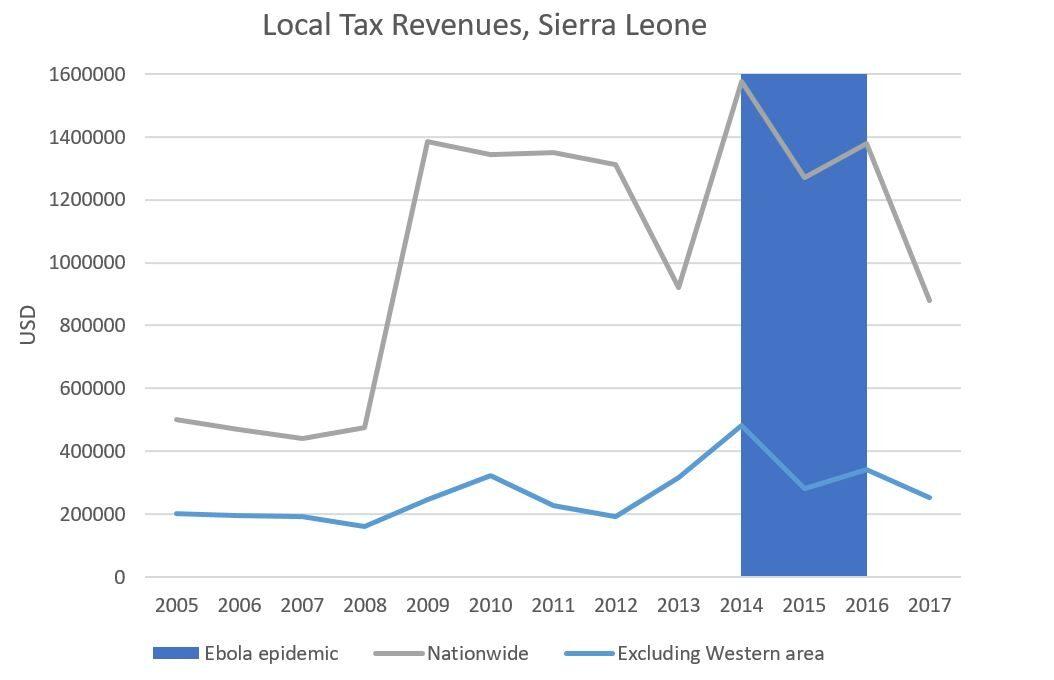

Fill the Gaps, Feel the Pain: Insights from Sierra Leone on an Epidemic's Impact on Local Taxation, Public Services, and the Poor | African Arguments

The Revenue Administration Gap Analysis Program in: Technical Notes and Manuals Volume 2021 Issue 009 (2021)