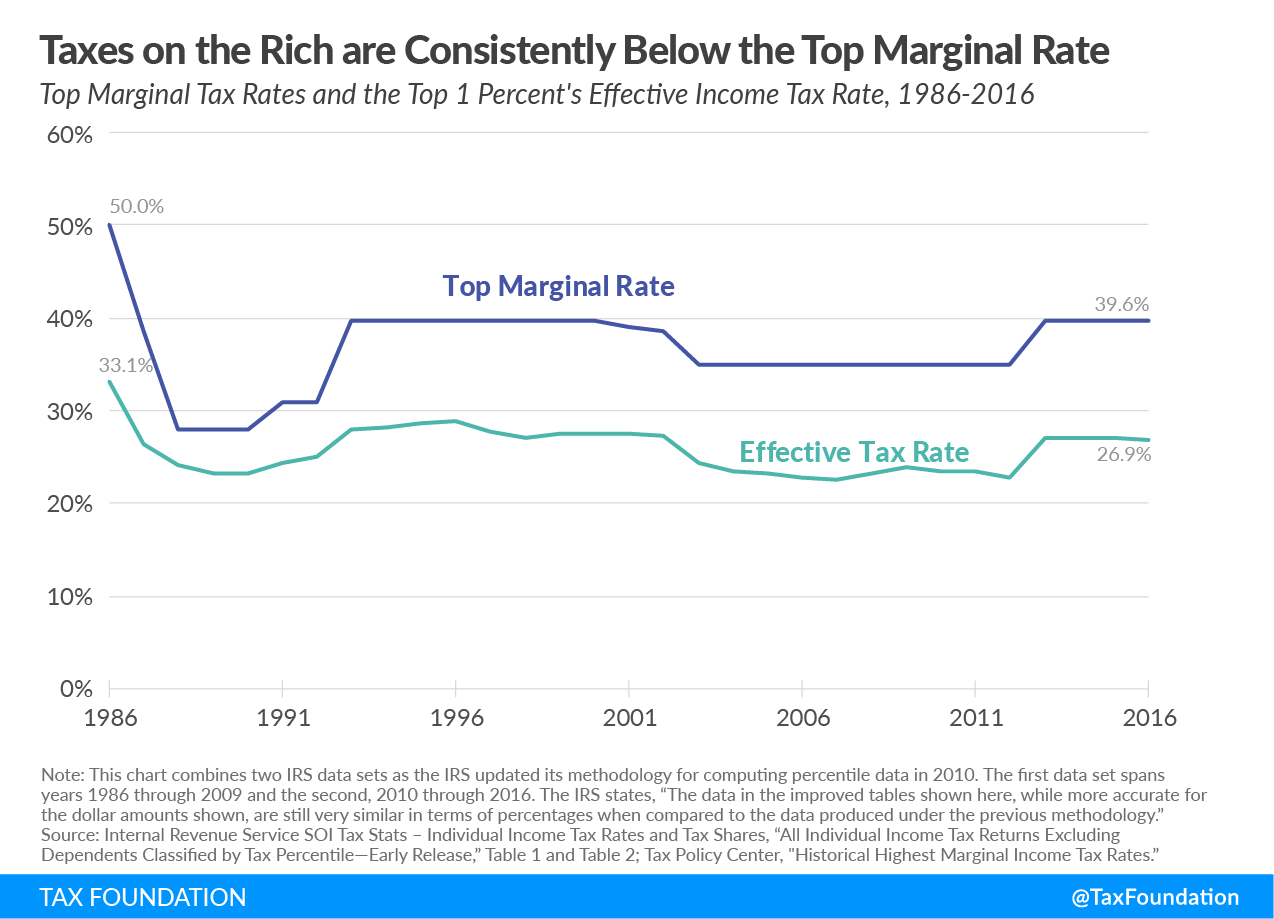

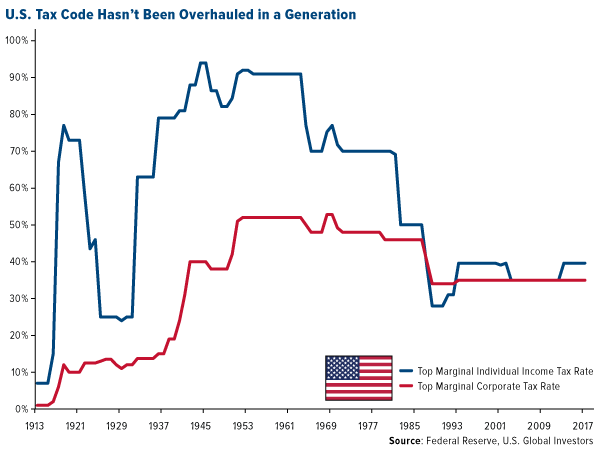

US Top Marginal Income Tax Rates 1913 To 2017: For Individuals vs. Corporations | TopForeignStocks.com

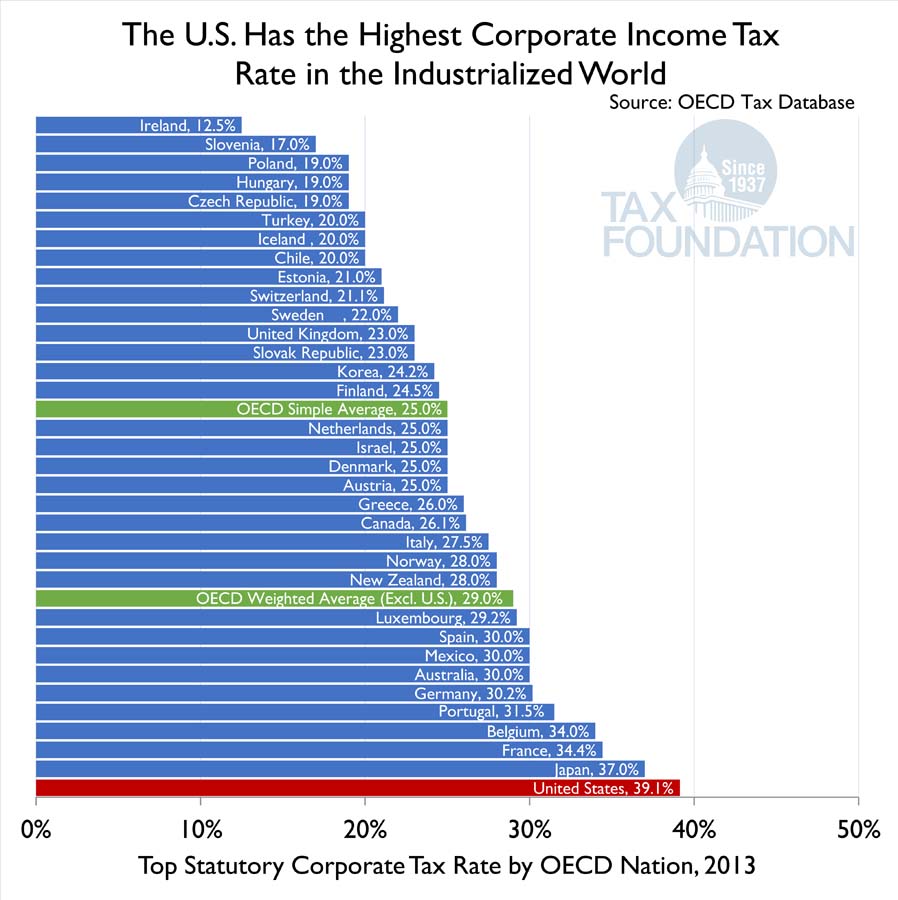

US Would Have Highest Top Income Tax Rate Among Developed Nations Under Biden Plan, New Analysis Warns - Foundation for Economic Education

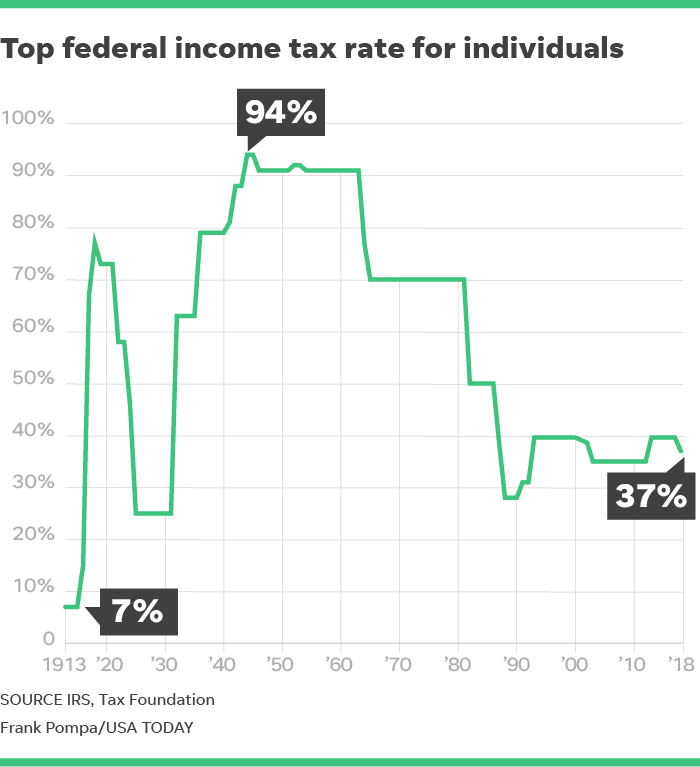

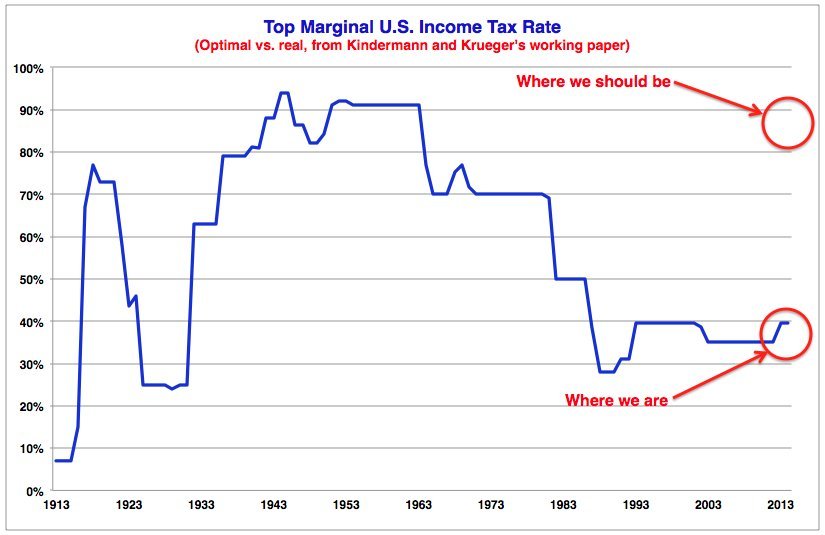

People keep saying that the income tax rate under Eisenhower was around 90%. Is that really true? - Quora

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-01-671165481d094f6bb0a0c363689bfa67.jpg)